Evidence-Based Solutions for Change

Explore comprehensive policy proposals backed by research, expert analysis, and proven results from institutions worldwide.

Explore comprehensive policy proposals backed by research, expert analysis, and proven results from institutions worldwide.

See how different policy proposals would affect your student debt situation

This relief would free up $1,272 annually for other economic activities, potentially boosting local economy participation.

Compare key proposals side-by-side to understand their scope, impact, and implementation requirements

| Policy Proposal | Relief Amount | Beneficiaries | Cost | Status | Support |

|---|---|---|---|---|---|

Universal $10K ForgivenessImmediate $10,000 debt cancellation for all borrowers |

$10,000 | 43M borrowers | $321B | Under Review |

|

Income-Based $50K ReliefUp to $50,000 forgiveness based on income thresholds |

Up to $50K | 36M borrowers | $750B | In Committee |

|

3% Interest Rate CapCap all federal student loan interest at 3% |

Varies | 45M borrowers | $45B/year | Active Bill |

|

Free Community CollegeFederal funding for tuition-free community college |

Prevention | 6M students/year | $109B/year | Proposed |

|

Understanding the legislative process and timeline for student debt relief policies

Administrative relief measures including payment pause extensions, interest rate adjustments, and targeted forgiveness programs for specific borrower groups.

Comprehensive legislative packages addressing broad-based forgiveness, interest rate reforms, and future cost controls currently under committee review.

Long-term structural changes to higher education funding, including free community college, expanded Pell Grants, and institutional accountability measures.

Leading economists, policy experts, and education researchers explain the implications of proposed solutions

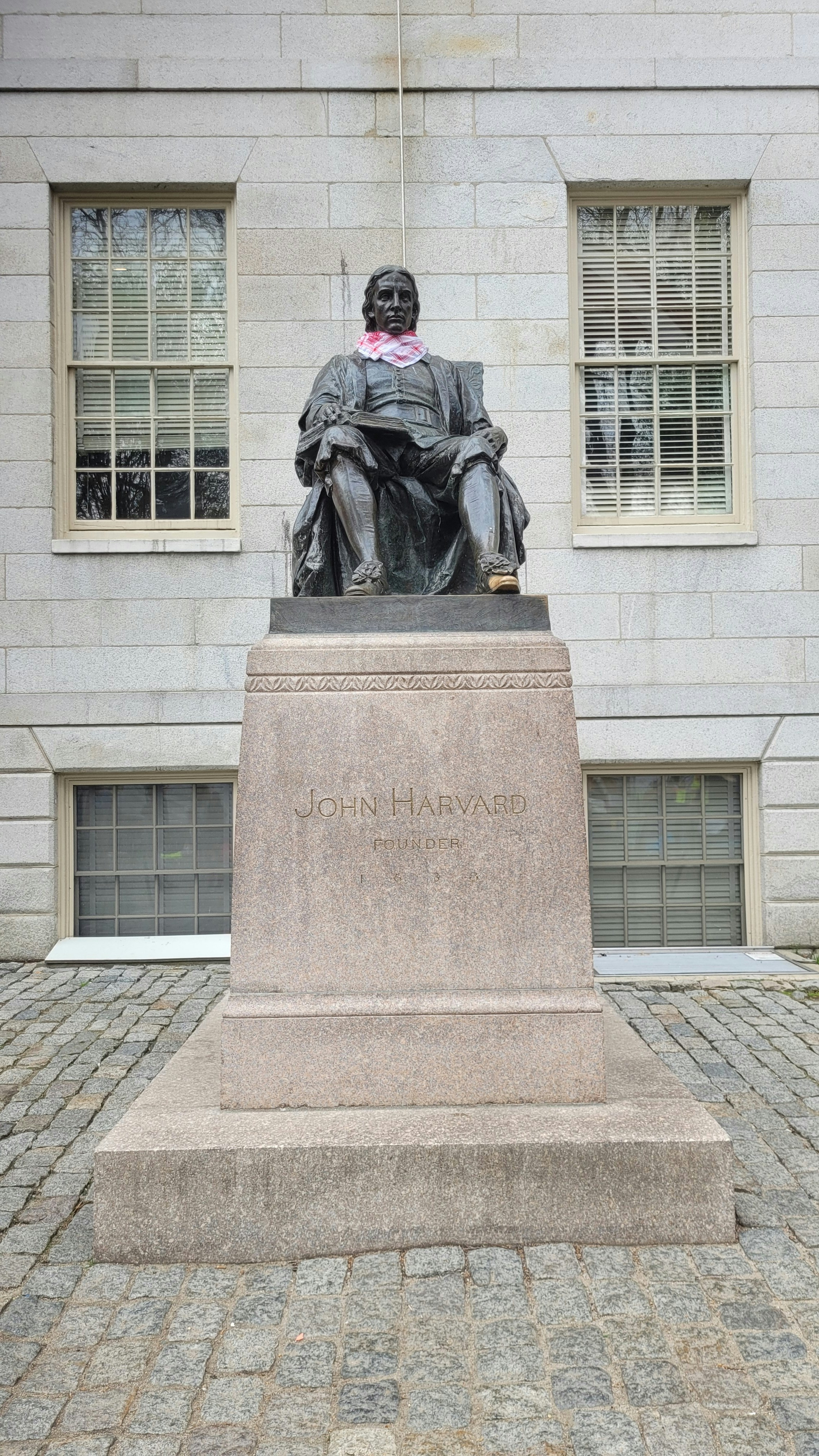

Economics Professor, Harvard

"Interest rate caps would provide immediate relief while maintaining borrower responsibility. This balanced approach addresses the crisis without creating moral hazard."

Policy Director, Brookings

"Free community college represents the most cost-effective prevention strategy. Every dollar invested saves $4 in future debt relief needs."

Former DOE Official

"Income-driven repayment reforms must be paired with forgiveness to prevent indefinite debt cycles. The current system traps borrowers in perpetual payments."

Pre-written messages and talking points to effectively advocate for student debt relief with your elected officials

Real-time updates on the status of student debt relief legislation and policy developments

Active Bills in Congress

Committee Actions This Month

State-Level Initiatives

Since Last Major Update

The Student Loan Interest Rate Reduction Act passed subcommittee review with bipartisan support, moving closer to a full House vote.

California announces $500M state-funded student debt relief program for healthcare workers and teachers.

New income-driven repayment regulations will reduce monthly payments for 85% of current borrowers starting July 2025.